Breaking Into Wall Street Platinum By Brian DeChesare – Free Download All BIWS Courses

Yiu’ll Get Full Acccess to BIWS Platinum, the Ultimate Course Collection If You Want to Outpace Other Interviewees, Win More Offers at the Top Firms, and Advance Rapidly On the Job While Saving Nearly $1,500 at the Same Time!

✅ About This Courses Bundle:

✅ Courses Author: Brian DeChesare

✅ Official Courses Price: $1197

✅ Free For Our VIP Members? : Yes

✅ Download Links : Mega & Google Drive

✅ Download Size : 52.06 GB

✅ Updatable? : Yes, all future updates included.

✅ Sales Page : You can check at the bottom of this page.

Here’s What You Get & Learn With This Course:

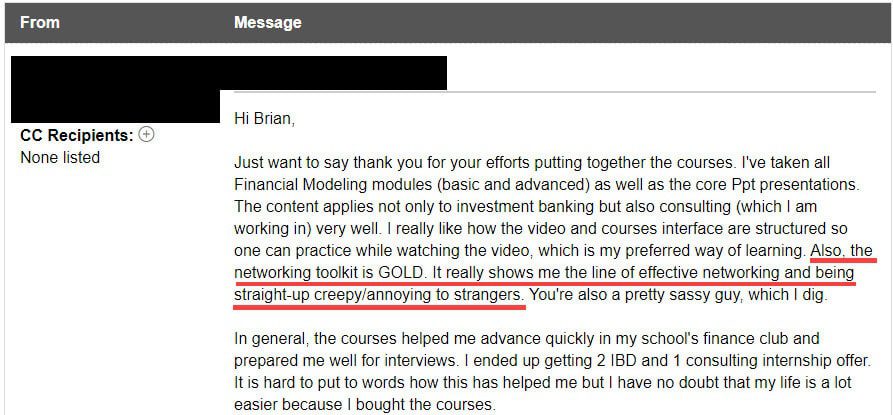

Course #1: IB Networking Toolkit

WHY IT’S IMPORTANT: This course helps you win interviews and makes it easy to advance throughout your career

The Investment Banking Networking Toolkit makes it easy to create valuable contacts and connections that will ease your way into a great job in the finance industry. Learn how to find names and contact information, how to plan your informational interviews and cold calls, and how to break into finance – without stressing yourself out or feeling “pushy.”

You get 37 video and audio files, along with dozens of bonus email templates, networking success case studies, and a module on how to use LinkedIn effectively. Everything is presented in multiple formats, so you can watch, listen, or read, depending on your preferred learning style.

To accelerate your networking, we even give you the names and descriptions of 4,178+ investment banks, 11,306+ private equity firms and 3,190+ hedge funds, organized by region (Note: These include main phone numbers and email addresses/physical addresses, but are not specific people at each firm).

Course #2: IB Interview Guide

WHY IT’S IMPORTANT: This course helps you pitch yourself, answer “fit” questions, and master the trickiest technical interview questions

This is your “Interview Action Plan” – it gives you preparation checklists for interviews, shows you how to walk through your resume and background with 18 templates, and explains how to prepare efficiently for the “fit” and qualitative questions (with tutorials, dozens of sample questions and answers, and more).

There are also 578+ pages of detailed coverage of the technical topics, including material that no other guide on the planet teaches (e.g., private companies, ECM/DCM/Leveraged Finance, and industry-specific questions). And then there are 18+ Excel files you can use to understand all these concepts in-depth, along with 218+ quiz questions you can use to test yourself.

In addition to all that, you can test your skills with the 17 practice case studies – ranging from 3-statement modeling to valuation/DCF to M&A and LBO-related exercises. These are very similar to the tests you’d have to complete at assessment centers in the EMEA region and in more advanced interviews.

The guide is comprehensive, but efficiency is the goal as well – which is why we provide study plans for 4 hours, 2 days, and 1 week of preparation time. If you have more time than that, great! But make sure you master the fundamentals outlined in these plans first.

Course #3: Excel & VBA

WHY IT’S IMPORTANT: These lessons give you a crash course in the Excel and VBA skills that you’ll use to model and value companies and analyze transactions

Master Excel, and you’ll be well ahead of the competition before you even step into the office on the first day of the job.

You’ll learn everything from core Excel shortcuts, navigation, and formatting up through formulas, graphing, and data analysis, and how to use Visual Basic for Applications (VBA) to automate your workflow and save time on the most common tasks – so you leave the office earlier and get a higher bonus.

You’ll learn the ropes with two case studies, one based on a valuation of Walmart and one based on a customer due diligence analysis in a deal, and you’ll super-charge your productivity with our custom BIWS Macros package and Quick Access Toolbar (QAT) – plus, detailed written guides and quiz questions so you can test yourself on everything.

Excel is the core skill required in virtually all front-office finance roles, and you’ll be well ahead of the curve after completing this course.

Course #4: Core Financial Modeling

WHY IT’S IMPORTANT: This course helps you master the foundational accounting, valuation, and financial modeling skills that you’ll use in investment banking and corporate finance roles

In this course, you’ll learn accounting, valuation, and financial modeling from the ground up with 10+ real-life case studies from around the world, including: Monster Beverage (U.S.), Stadler Rail (Switzerland), Coles (Australia), Vivendi (France), Steel Dynamics (U.S.), NichiiGakkan (Japan), the Great Canadian Gaming Corporation (Canada), and Netflix (U.S.).

This courses focuses on both interview prep and on-the-job skills and is especially useful if you’re preparing for a new internship or full-time job. You’ll learn the concepts so well that you won’t have to “memorize” anything for interviews, and you’ll get plenty of references you can use in real life, including 3-statement models, valuations and DCF analyses, merger models, and LBO models.

These are the fundamental skills you’ll need in in any sector in the finance industry – and you’ll be ahead of the game by mastering them before you start working. Each topic has an introductory and “more advanced” version, so you can pick and choose the lessons that are most appropriate for your skill level and time requirements.

Course #5: PowerPoint & VBA

WHY IT’S IMPORTANT: This course saves you hours of time each day, lets you leave the office earlier, and gives you dozens of templates that will speed up your own presentations and pitch books

When it comes to entry-level jobs in investment banking, your PowerPoint skills can make or break you.

You’ll spend much of your time in PowerPoint, and you won’t have time to decipher Microsoft’s cryptic “Help” articles. Your bosses will expect professional pitch books and presentations on a deadline – so you better be able to deliver.

PowerPoint & VBA teaches you everything you need to know about PowerPoint for investment banking, private equity, and hedge fund roles – from setting up the interface to optimizing your speed and efficiency, to navigation, slides, shapes, alignment, distribution, grouping, formatting, and more.

You’ll learn how to use the Slide Master and Sections effectively, and you’ll get plenty of practice exercises with tables, images, Excel charts and graphs, and more.

Oh, and you’ll also get our full macro package that automates 25+ common tasks in IB-style presentations, along with a VBA crash course that explains everything and practice exercises that teach you how to use these macros.

The entire course is based on a sell-side M&A pitch book and valuation for Jazz Pharmaceuticals, which was inspired by examples of biotech pitch books and valuations produced by real banks (the links are in the course).

Course #6: Project Finance & Infrastructure Modeling

WHY IT’S IMPORTANT: This training gives you a crash course in modeling for energy and transportation assets, from cash flows to debt sizing and sculpting

This course gives you the TL;DR version of what’s most important for Project Finance and Infrastructure Investing roles: simple, efficient models that let you quickly make investment decisions about acquisition and development deals.

You’ll learn about projecting electricity generation, traffic levels, revenue, and expenses, and you’ll understand how to use those to forecast the future cash flows and sculpt and size the Debt based on that profile.

And you’ll understand concepts like construction timelines and flags, debt refinancing, DSCR and LLCR-based constraints via the 4 case studies in the course (toll roads, solar, wind, and a natural gas power plant).

Course #7: Venture Capital & Growth Equity Modeling

WHY IT’S IMPORTANT: This training gives you a crash course in everything related to startups and growth firms, from cap tables to valuation and exit modeling

When you interview at venture capital and growth equity firms, you’ll be tested on a range of topics that most bankers never deal with: cap tables, “down rounds,” SAFE notes, flow of funds models, primary vs. secondary shares, and, most importantly, how to make investment recommendations for these companies.

There are plenty of VC-related books and courses out there, but they make the critical mistake of focusing on term sheets and trivia rather than what actually matters – your ability to analyze and value startups and say “yes” or “no” to each one.

This training gets you up to speed quickly on all the key topics, based on 5 short case studies (Seed and Series A – D companies) and 2 longer, more detailed case studies based on tech startups at different stages.

Course #8: Advanced Financial Modeling

WHY IT’S IMPORTANT: This course lets you master more complex, “on the job” investment banking models as well as private equity, hedge fund, and credit case studies

This course is the best training if you want to advance in investment banking while also considering buy-side options, such as private equity, hedge funds, and credit investing roles.

It includes case studies in each area, including an advanced LBO model and a take-home private equity case study, several advanced M&A models for investment banking (quarterly merger model, spin-off, and minority-to-majority stake), and a detailed hedge fund valuation and stock pitch based on Jazz Pharmaceuticals.

You’ll even learn about credit, convertible bonds, and debt vs. equity via two case studies, both with models built from blank Excel sheets (for EasyJet and Netflix).

This course focuses on the details and nuance that you’d see on the job, but not in the normal “interview prep” material.

Course #9: Real Estate & REIT Modeling

WHY IT’S IMPORTANT: This course lets you dominate your commercial real estate, real estate private equity, real estate investment banking, and other RE-related interviews and case studies

Get the bleeding edge advantage you need to master real-world real estate and REIT financial modeling and valuation… with 8 short case studies and 9 longer, more in-depth case studies from around the world, including multifamily, office/retail, industrial, hotel, and condominium properties, and hotel, office, multifamily, retail, data center, and industrial REITs.

Topics covered include real estate development and acquisition modeling, waterfall returns, debt and equity draws, tenant-by-tenant lease modeling, and 3-statement projections, valuation, debt vs. equity, M&A and merger models, and LBO models for REITs… and much, much more.

In each case study of the course, we walk you through not only the Excel model and step-by-step process to build the formulas, but also the thought process and how to make an investment recommendation at the end, including how to identify the risk factors and ways to mitigate them.

The coverage is global, with examples from the U.S., U.K., Canada, Brazil, the UAE (Dubai), France and Spain, Singapore, Australia, and Hong Kong.

Throughout the course, we use real properties and companies – such as 100 Bishopsgate in London, The Lyric in Seattle, the Jumeirah Beach Hotel in Dubai, and, on the REIT side, AvalonBay in the U.S., SPH REIT in Singapore, Digital Realty / DuPont Fabros in the U.S., and Pure Industrial Real Estate Trust in Canada.

There are 114 videos, as well as 300+ pages of written guides, case study documents, investment recommendation outlines and full presentations, and more – so you can review the key points and get up to speed quickly.

Course #10: Bank & Financial Institution Modeling

WHY IT’S IMPORTANT: This course helps you develop valuation and modeling expertise specific to banks and financial institutions, including how to make investment recommendations

Master the fundamentals and the nuances of bank and financial institution accounting, valuation, and financial modeling with detailed, step-by-step video training.

This course is based on four detailed, global case studies: An operating model and valuation for Shawbrook, a U.K.-based “challenger bank,” a merger model for KeyCorp’s $4.1 billion acquisition of First Niagara, a potential growth equity investment in ANZ, and a 100% buyout of the Philippine Bank of Communications.

Each case study concludes with a client advisory presentation or investment recommendation, and there are simplified and more complex versions of each model. Plus, you get a set of bonus lessons on accounting and valuation for insurance companies.

It’s the only FIG training on the planet that explains how to use modeling techniques to write stock pitches for commercial banks – a required part of any asset management or hedge fund interview. And then you also get a crash course on equity research reports and investment banking pitch books.

You’ll gain immediate access to the 103 instructional videos, the stock pitch, ER report, and IB pitch book, the extensive written notes, the practice quiz questions, and the Quick Start Guides so you can quickly grasp the concepts and practical skills taught in the course.

? Plus The Entire Package Comes With The Following:

Valuable Tools To Accelerate Your Learning:

FULL Subtitles/Captions and Transcripts

365-Day-per-Year Q&A

Cheat Sheets and Written Guides

Free Updates

Watchable on ANY Device

Expert Support

Quizzes and Certifications

✅ Great X Courses Guarantee : At Great X Courses, we insist in providing high quality courses, with direct download links (no paid links or torrents). What you see is exactly what you get, no bad surprises or traps. We update our content as much as possible, to stay up to date with the latest courses updates.

You can find more info on the sales page here.